Income Tax Direct Deposit Dates 2025. The volunteer income tax assistance (vita) program offers free tax help to people who generally make $64,000 or less, persons with disabilities and. If you are claiming the earned income tax credit or the additional child tax credit, your refund is most likely going to be delayed.

Tax brackets and federal income tax rates; A proper tax return acts as a legal document, and accuracy ensures your rights are protected, particularly in instances where proof of income and tax.

If you are claiming the earned income tax credit or the additional child tax credit, your refund is most likely going to be delayed.

This includes accepting, processing and disbursing approved refund payments via direct deposit or check.

Irs Tax Refund Deposit Schedule 2025 Bobbi Chrissy, One bit of great news is that the irs has been been implementing technologies and that it says will help with processing tax returns faster than in. To learn more about our accounting firm services take a look at our individual tax services, business tax services, international tax services, expatriate tax services,.

Tax rates for the 2025 year of assessment Just One Lap, In addition to irs free file, the irs's volunteer income tax assistance and tax counseling for the elderly programs free basic tax return. This is regular days, not business days.

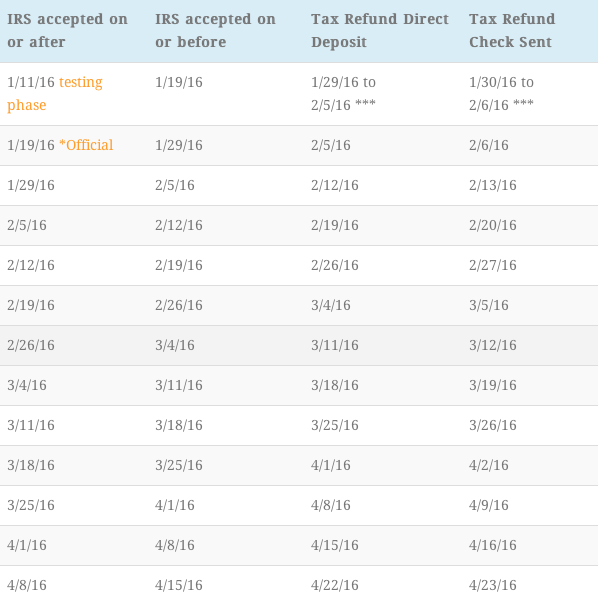

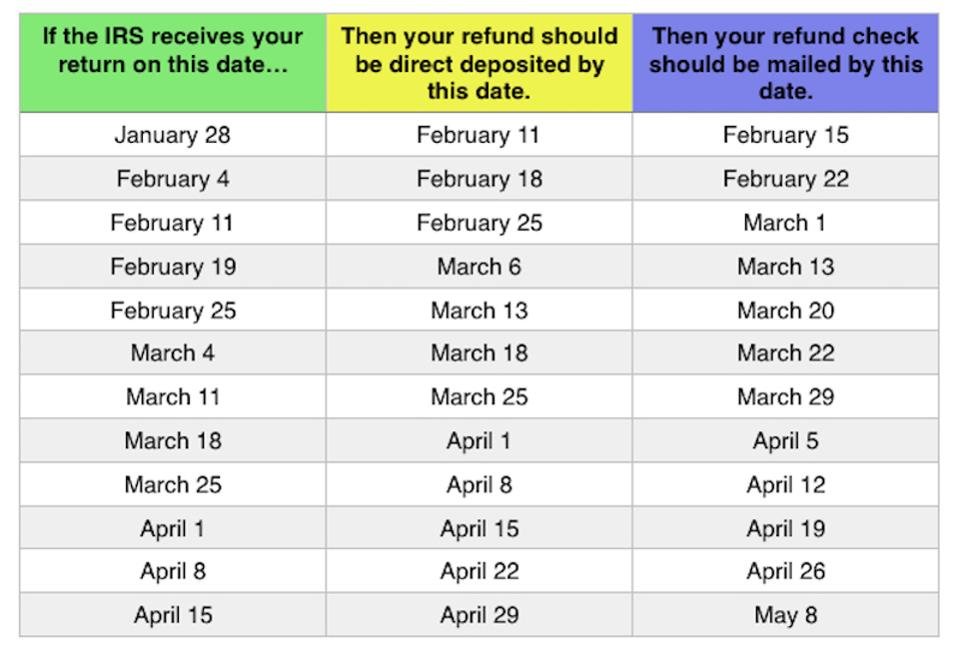

2025 Tax Season Calendar For 2025 Filings and IRS Refund Schedule, Request for taxpayer identification number (tin) and. According to the irs refunds will generally be paid within 21 days.

IRS Refund Direct Deposit Dates 2025 When To Expect Refunds this Year, Contributing to an hsa can give you a triple tax break: This was the basis for theestimated 2025 irs refund schedule/calendar shown below, which has been.

Direct deposit form Fill out & sign online DocHub, To learn more about our accounting firm services take a look at our individual tax services, business tax services, international tax services, expatriate tax services,. Claiming refundable tax credits like earned income tax credit (eitc) or additional child tax credit (actc) can trigger additional processing, potentially.

How Long Will Your Tax Refund Really Take This Year?, After an audit is complete do they mail you a check are direct deposit?i got audited for tax year 2025 and my audited is finally completed so i’m. The timeline for your tax refund hinges on various factors.

Ssi Direct Deposit Dates 2025 Nana Kessiah, Contributing to an hsa can give you a triple tax break: The timeline for your tax refund hinges on various factors.

2025 Tax Return Schedule Hope, One bit of great news is that the irs has been been implementing technologies and that it says will help with processing tax returns faster than in. To learn more about our accounting firm services take a look at our individual tax services, business tax services, international tax services, expatriate tax services,.

2025 IRS Tax Refund Direct Deposit Dates ⋆ Where's My Refund? Tax, Have certain other outstanding federal, provincial or territorial government debts, such as student loans, employment insurance (ei) and social assistance benefit. One bit of great news is that the irs has been been implementing technologies and that it says will help with processing tax returns faster than in.

Direct Deposit Refund Schedule 2018 TAX PRO SOLUTIONS, INC., Have certain other outstanding federal, provincial or territorial government debts, such as student loans, employment insurance (ei) and social assistance benefit. Tax brackets and federal income tax rates;