Gift Tax Limit 2025 Over 50. The irs has specific rules about the taxation of gifts. The irs recently announced increases in gift and estate tax exemptions for 2025.

Starting january 1, 2025, the annual gift tax exclusion will increase to $19,000 per recipient, up from $18,000 in 2025. There’s no limit on the number of individual gifts that can be.

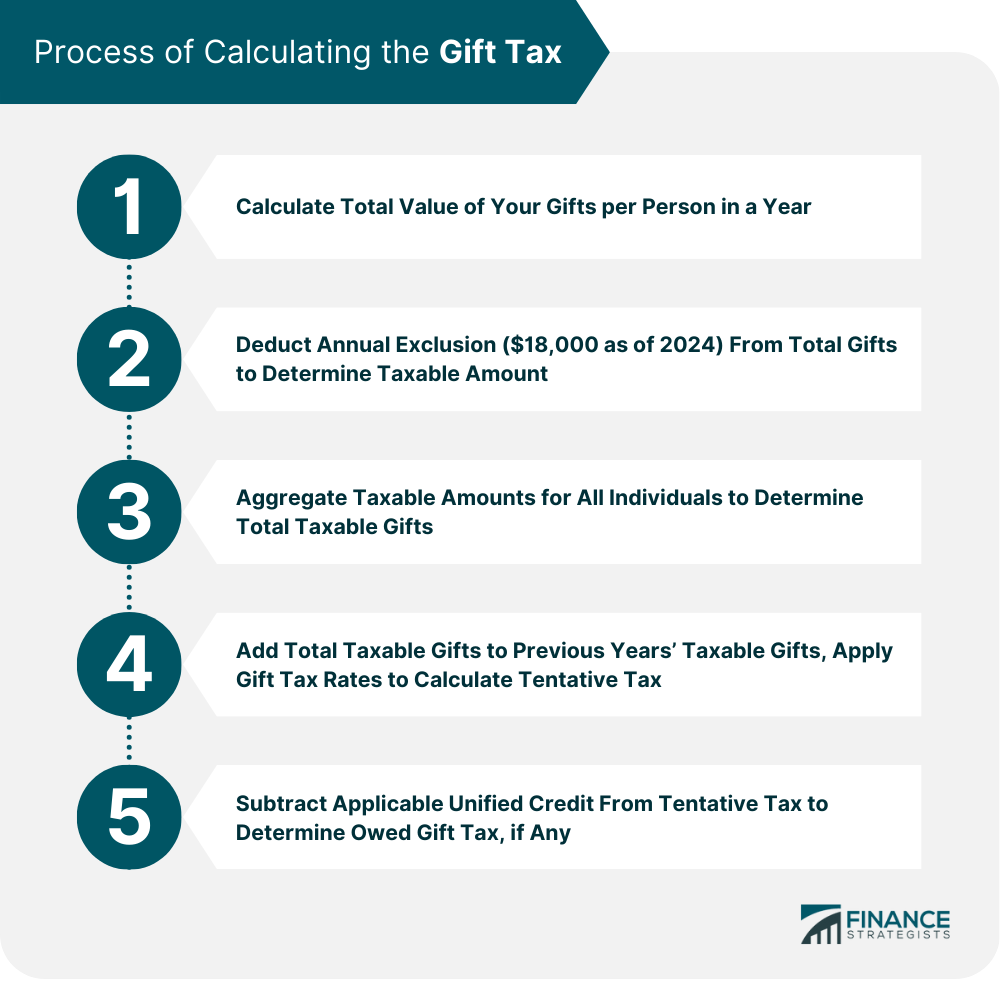

Yearly Gift Limit 2025 Ruby Sana, You can use this gift tax calculator to determine the amount of tax you owe over a given taxation period.

Annual Gift Tax Limit 2025 Sonni Elfrieda, The internal revenue service has determined that $19,000 in 2025 is the annual gift tax exclusion and permits individuals to transfer wealth.

Gift Tax 2025 Limit 2025 Zoe Lyman, The irs recently announced increases in gift and estate tax exemptions for 2025.

What Is The Lifetime Exclusion For Gift Tax 2025 Teresa Claire, For example, if you gift $30,000 to one recipient in a year, you would be over the limit by $11,000.

2025 Ira Contribution Limits Ana Harper, You can gift this amount to as many individuals as you’d like without triggering a gift tax.

401k Contribution Limits 2025 Catch Up Grayson Malik, The irs recently announced increases in gift and estate tax exemptions for 2025.

Roth Ira Contribution Limits 2025 Catch Up Lucia Elise, Married couples may gift up to $38,000 per recipient annually without.

Ira Limits 2025 Contribution Tax Sophia Noor, The gift tax limit, also known as the gift tax exclusion, is $18,000 for 2025.

2025 Max 401k Contribution Limits Catch Up Ines Riley, The irs recently announced increases in gift and estate tax exemptions for 2025.